Our society would be considerably more democratic, prosperous and caring if we narrowed the vast gap between the very wealthy and everyone else."

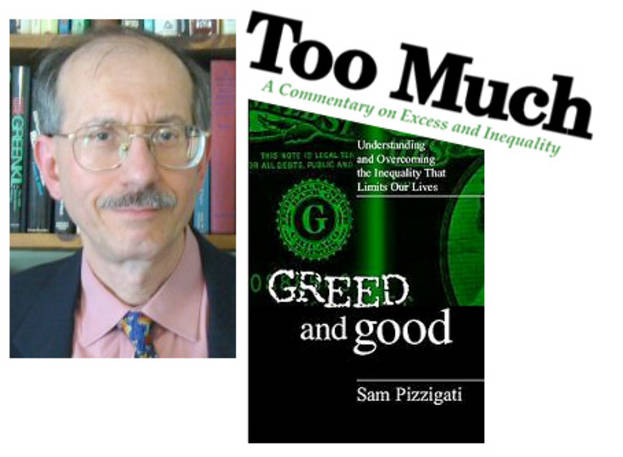

Sam Pizzigati promotes this vision of a more equitable

America through his (free) online weekly journal, Too Much [2]. The journal, which Pizzigati launched in 1995 as a print publication, highlights the gap between the rich and poor in

America, exposing the outrageous excesses of the super-rich while advocating for public policies that reduce inequality. Too Much is a great source of information and clear, accessible analysis, a valuable resource at a time of economic collapse and billion-dollar bailouts of the financial industry.

Pizzigati is a veteran labor journalist and activist who credits his Italian immigrant grandfather, a socialist, with influencing his progressive politics. In the late 1970s, he and several other Italian American leftists organized the Committee for a Democratic Policy toward Italy. The group, which had several chapters across the country, advocated a non-interventionist U.S. policy toward the proposed “historic compromise” between

Italy’s Communists and Christian Democrats. (The rapprochement, which

Washington opposed, ultimately failed.) In 1992, Sam was a signatory to the founding statement of Italian Americans for a Multicultural United States (IAMUS), an advocacy group organized by New York-area Italian Americans, including myself.

A Long Island native, Sam Pizzigati lives in

Maryland. He currently is an associate fellow at the Institute for Policy Studies [3] in

Washington, D.C. I interviewed Sam by e-mail this week.

Why did you create Too Much, and who is its audience?

Too Much came about for a simple reason. We have too much inequality in the

United States, too much wealth concentrated in the pockets of a few — and too little debate about what this concentration means for us as a people. A century ago, in a period of deep inequality really similar to ours today, we had journalists and politicians debating the distribution of wealth and income all the time. We need to restart that debate. That’s what Too Much is trying to do.

Too Much has a fairly broad audience, everyone from social justice activists and academics to media types and business people angry about the greed they see distorting our economy. They all find facts and stats in Too Much, but lots more, too. We work to go beyond the inequality numbers. We look at how grand concentrations of private wealth are corroding every aspect of our lives, from sports and art to our health and environment.

What are the worst instances of income inequality, and what are their effects on the American working and middle classes?

I think we can look at disparities in two ways. We can look, for starters, at the incomes specific individuals are taking home. Last year, five hedge fund managers in the

United States each cleared over a billion dollars in income. The average person in the

United States would have to work 25,000 years to make a billion dollars. But I think we also need to step back and look at the bigger picture. I grew up in the 1950s. Back then, average working families — what economists like to call the bottom 90 percent of the income distribution — took home two-thirds of

America’s income. And today? Right now, the bottom 90 percent of us are only taking in half the nation’s income. The top 1 percent, meanwhile, have seen their share of the nation’s income nearly triple, from around 8 percent of the total to over 22 percent. You can’t understand our current economic meltdown without understanding how much we’ve let wealth get redistributed to the top. More dollars at the top mean more dollars for speculation. Fewer dollars in the pockets of average folks mean higher levels of household debt. Add the two and you have the perfect recipe for a bursting bubble economy.

We have a minimum wage in the

U.S. You are suggesting that we also need a maximum wage. How would that work, and for whom would the maximum be set?

Franklin D. Roosevelt once actually proposed what amounted to a “maximum wage.” In 1942, FDR called for a 100 percent tax on all individual income over $25,000, about $315,000 in today’s dollars. Congress didn't buy FDR's 100 percent rate. But lawmakers did set the top tax rate at 94 percent on income over $200,000, and that rate would hover around 90 percent for the next two decades, years that would see the greatest period of middle class prosperity in U.S. history. I’d like to build on FDR’s spirit, with a maximum wage set as a multiple of the minimum wage, say 10 or 25 times. How would this work? Any income over ten times the minimum wage would face a 100 percent tax. The higher the minimum, the higher the maximum. Just imagine the social dynamic that this approach to a maximum wage would create. Our nation’s richest and most powerful, if this ten times rule were in effect, would have a vested self-interest in enhancing the well-being of our nation’s poorest and most vulnerable.

Do you think the Obama victory means that Americans might finally be getting fed up with corporate greed and malfeasance?

Yes, I really do. The McCain campaign tried to make “spreading the wealth” a string of dirty words. The American people weren’t buying. Barack Obama now has about as clear a mandate he could possibly have to get the

United States back on track toward greater equality.

During the presidential campaign Obama used the “R” word – redistribution – leading right-wingers to call him a socialist. Do you think that the Obama administration is likely to enact policies to reduce economic inequality?

Obama’s tax proposals, if enacted, would indeed reduce inequality. Obama has proposed, for instance, raising the tax rate on income in the top tax bracket from 35 to 39.6 percent, the rate in effect the year before George W. Bush became President. But we can’t afford to stop there, at 39.6 percent. Getting back to the Clinton-era top tax rate on the rich would only reduce the growth in income inequality since the late 1970s, as the Brookings Institution has noted, by one-sixth. We need to do better than that. How much better could we politically do? The tax rate on top-bracket income in the Eisenhower years stood at exactly 91 percent. If Americans speak out loudly enough, I believe the Obama administration will move, as time goes on, in an Eisenhower tax-the-rich direction.

We’ve seen much demoralization under Bush and the GOP, but now there’s much talk of an energized citizenry. What can Americans do to keep Obama and the Democrats from capitulating to corporate interests?

The single most important thing that I think Americans can do right now: help pass the Employee Free Choice Act, a pending piece of legislation that aims to make it easier for workers to organize into unions and bargain collectively with their employers. Obama has already endorsed this legislation, but Corporate America is mobilizing a huge campaign to kill it. The high levels of economic equality — and middle class prosperity — that Americans enjoyed in the mid 20th century had two institutional pillars: a steeply graduated progressive income tax and a strong, vital trade union presence. If we can restore that vital union presence, we’d have the political clout to restore a truly progressive tax structure.

You are an Italian American. Has ethnicity, perhaps combined with your experience of class, had any influence on your political views?

Definitely. My grandfather Tranquillo arrived at

Ellis Island at the height of the first great immigration wave, in 1905. He ended up on Long Island, where he worked as a chauffeur and gardener on one of the grand estates that dominated

Long Island back then. Later, in the 1930s, my grandfather became a Socialist Party organizer. He ran for sheriff of

Nassau

County, on the Socialist ticket, in 1937, and collected more votes, our family story goes, than the Democrat. My grandfather never won any office, but the battles he and his fellow activists fought — for high taxes on the rich, for unemployment insurance and old-age security, for a minimum wage — eventually became law and set the stage for the middle class prosperity his children enjoyed. I like to think that if he were around today, he’d be reading Too Much and smiling.

Much has been said about the extreme economic and political corruption in

Italy, and on the symbiotic relationships between organized crime and economic and political elites. But in America don’t our corporate chieftains behave like mafiosi?

Well, let’s look at a corporate chieftain who happens to have a name that ends in a vowel, Robert Nardelli, the current CEO at Chrysler. Nardelli first made national headlines early last year when he walked away from his chief executive suite at Home Depot with over $200 million in severance. The Home Depot board had brought Nardelli in, from General Electric, because the directors wanted to see higher corporate earnings and they figured they needed an executive superstar to get them. And Nardelli did produce higher earnings — by running Home Depot into the ground.

Home Depot had built customer confidence by filling store aisles with expert employees who knew their fixer-upper stuff. Nardelli replaced thousands of these dedicated full-timers with cheaper — and much less knowledgeable — part-timers. Local store managers didn’t much like that. Nardelli’s reaction? He snatched away local store manager authority and filled Home Depot with ex-G.E. executives with no retailing experience. Home Depot has never recovered from all these changes. Nardelli himself may have actually pocketed more money from his half-dozen years at Home Depot than

America’s Italian-American Mafia bosses made, all together, over the entire 20th century. He didn’t have to bust any heads. He just broke hearts.

For a free subscription to Too Much: http://toomuchonline.org/signupfull.html [4]

Source URL: http://test.casaitaliananyu.org/magazine/focus/facts-stories/article/its-all-too-much

Links

[1] http://test.casaitaliananyu.org/files/pizzigati1227486202jpg

[2] http://toomuchonline.org/index.html

[3] http://www.ips-dc.org/

[4] http://toomuchonline.org/signupfull.html